Highly fragmented, well-organized and relatively robust despite a shortage of drivers and rising costs – that’s the Spanish transport sector. Find out everything else you need to know here.

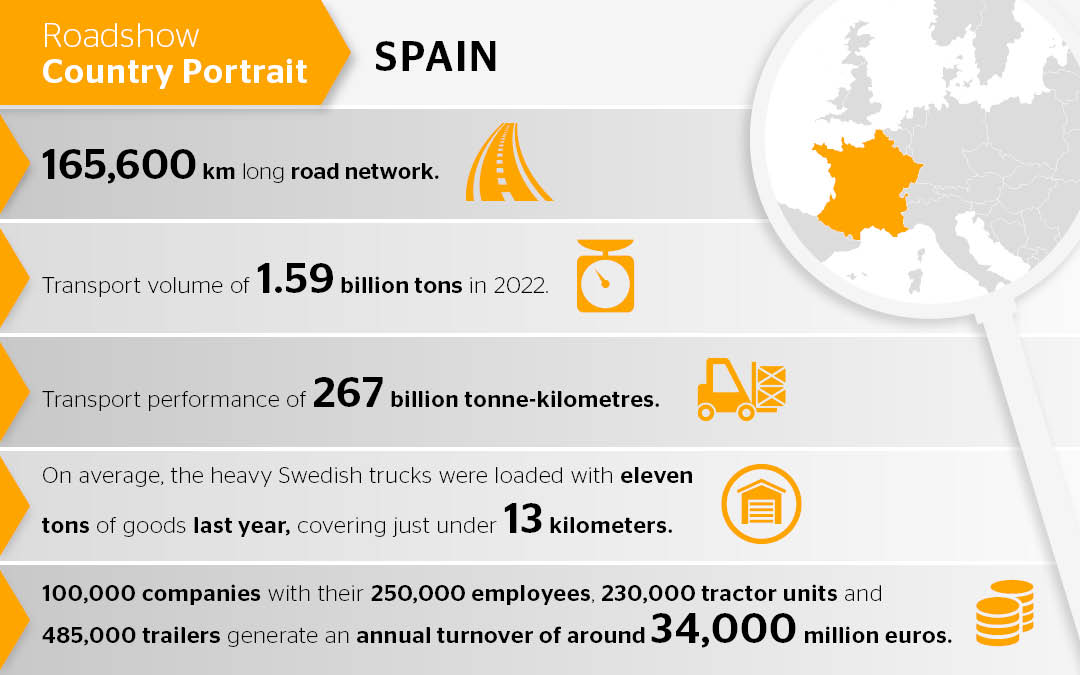

With a transport volume of 1.59 billion tons (2022) and a transport performance of 267 billion tonne-kilometres, freight transport is a significant economic factor in Spain. 95 percent of Spanish freight transport is handled via the more than 165,600 km long road network. 2,500 kilometers of these are freeways, of which more than 600 kilometers are now toll-free. There is also an extensive network of toll-free, state-financed urban highways, known as autovias.

Traffic jams build up in Spain’s major cities at peak times. Photo: Adobe Stock

Traffic jams build up in Spain’s major cities at peak times. Photo: Adobe Stock

The Spanish market for road freight transport is highly fragmented. In fact, the five largest companies – Dachser, DSV, Primafrio, Seur Geopost SL and XPO Logistics Inc. – have a combined market share of just 5.20 percent.

More than 94 percent of freight forwarding and removal companies are very small, with fewer than 10 employees. Companies with just one employee make up more than half of all road haulage and removal companies (64 percent). The total of over 100,000 companies with their 250,000 employees, 230,000 tractor units and 485,000 trailers generate an annual turnover of around 34,000 million euros.

Stable market

Road freight transport continues to focus on the domestic market, which accounts for more than two thirds of the sector’s total activity. Cross-border freight transport is concentrated on long distances of around 1,000 kilometers on average. With an average annual growth rate of 0.24% per year, this sector is relatively stable.

Good business in France

Cabotage services account for more than 3.5% of Spanish international road haulage, or just under 1.2% of the sector’s total activity. The main market for the Spanish is France, which accounts for 89% of total cabotage services. The volume more than tripled in the eleven years from 2008 to 2019 alone, from 860 million tonne-kilometres to 2,617 million.

Together with Germany, France is also the country’s most important trading partner, mainly importing and exporting vehicles, fuels, pharmaceutical products, machinery and electrical appliances.

High degree of organization

Spanish haulage companies are well organized: The Confederación Espanola de Transporte de Mercancias (CETM) is the most important professional association in the sector. It represents more than 31,000 transport and logistics companies.

The Asociación del transporte Internacional por carretera (ASTIC) is there for Spain’s international freight forwarders. It has a good 200 members. The national federation of transport mainly represents independent hauliers as well as small and medium-sized transport companies – together more than 32,000 transport companies with over 60,000 vehicles.

Rising costs and a shortage of drivers

The high demand for transport services in Spain is also being met by too few driver to meet this demand. The main reason for this are the unattractive working conditions. Costs are also a problem for the industry: in Catalonia, for example, driver costs rose by 9.7% between 2015 and 2020 – from an average of EUR 37,890 per year to EUR 41,565.

The main reasons for this are the increase in the statutory minimum wage and the rise in travel allowances. Toll charges have also risen in the five years – by a whopping 25 percent. Also affected: the cost of maintenance and repairs (up 18.2 percent) and operating costs (up 8.2 percent).

Have you got any ideas on how Spain’s transport companies can get to grips with the driver shortage and rising costs? We look forward to your comment!

0 Comments